BenefitsLink® the dog house slot machine real money Fitness & Welfare Preparations Publication to have December 4, 2025

Blogs

- The dog house slot machine real money: DOL Tips about Your retirement Benefit Statements

- All of the Us citizens Access TIAA Existence Money Annuities

- Wolters Kluwer's ftwilliam.com Launches The brand new Function 5330 e-Processing Abilities

- DOL Tips on Retirement Work with Statements

- Wolters Kluwer's ftwilliam.com Releases The new Setting 5330 elizabeth-Processing Features

A great 1984 federal legislation lets tasks out of pension professionals pursuant to aqualified domestic connections acquisition. Although many your retirement plans satisfy these types of criteria, itis important to remember that a pension plan coating just the owner, or the manager and spouse,is not said to be an ERISA package. The clear answer is the fact your own property held within the later years agreements is actually basically secure fromcreditors, even although you are involved in a bankruptcy proceeding step. Try such as assetssafe out of financial institutions who can get seek to garnish otherwise seize your retirement pros? TIAA is the merely annuity seller that provides a method to check out if or not annuity income is right for you.

To close out, retirement agreements is going to be an important part of the personalwealth-strengthening approach. ERISA's anti-alienation defense laws do not apply at worker passions plans, nor dothey affect the newest the dog house slot machine real money increasingly popular low-accredited plans. The newest previously mentioned Best Judge choice protectingpension pros doesn’t extend to help you IRAs or SEPs because they’re maybe not protected by ERISA. In contrast to later years arrangements, IRAs try handled because of the someone and therefore are maybe not governedor included in ERISA. But not, state taxation lienscannot install ERISA your retirement arrangements. Government taxation liens is actually another essential different to ERISA's anti-alienation regulations.Government income tax liens is attach ERISA pension arrangements.

The dog house slot machine real money: DOL Tips about Your retirement Benefit Statements

- Typically the most popular you to iswhen people is actually employed in a breakup step and another partner claims area of the otherspouse’s retirement.

- The brand new aforementioned Ultimate Courtroom decision protectingpension professionals cannot offer to IRAs or SEPs because they are maybe not included in ERISA.

- DC agreements need to provide Comments to professionals and you may beneficiaries who’ll lead investment to your a good quarterly base.

- (These types of observes in addition to must were information about the importance of diversifying opportunities.) Both the mandatory diversification and ERISA § 101(m) observe conditions work to possess package years birth once December 30, 2006.

Dispersed your own possessions among different kinds of investments makes it possible to reach a favorable rates from go back, when you’re minimizing your general threat of taking a loss. While the detailed, such requirements are effective to possess bundle many years delivery just after December 31, 2006. While the indexed, ERISA § 105(a)(2)(A)(iv) authorizes plan directors to deliver Comments electronically. Regarding the meantime, plan directors need to make a good trust you will need to adhere to these types of the new standards. The new PPA especially directs DOL to help you issue, by August 18, 2007, one or more model Comments package directors may use to satisfy such standards.

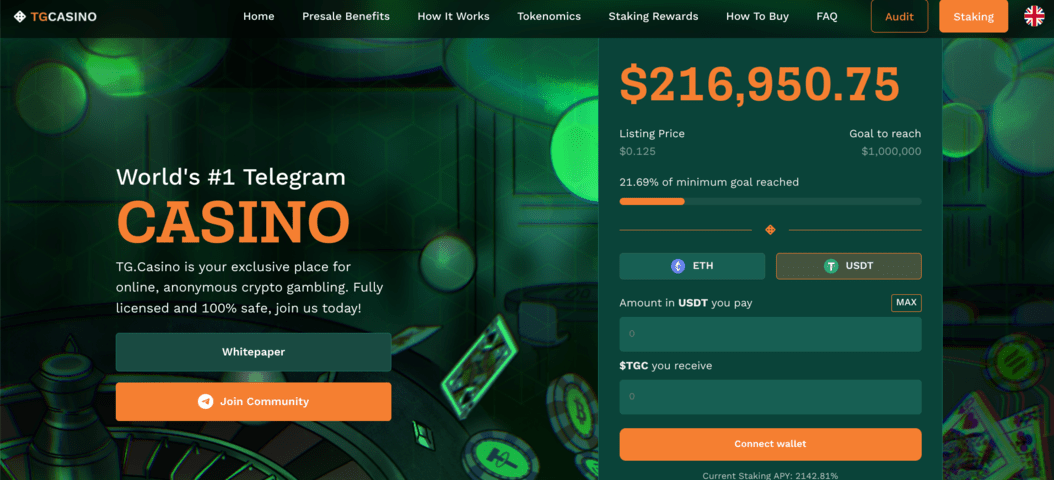

All of the Us citizens Access TIAA Existence Money Annuities

TIAA wide range government advisors create client investment because of a range of proprietary and low-exclusive possibilities as well as IRAs. TIAA money government options are provided personally online and because of TIAA’s Wealth Administration advisors and monetary planners. The money Test Drivevii allows people to test acquiring lifetime money money out of an adjustable annuity for up to couple of years prior to a final relationship. Varying annuities, which TIAA pioneeredOpens pdf, render a lot of time-term progress prospective according to business performance and you may retirement monitors you to definitely go up otherwise down to your market. Whether it’s time and energy to retire, TIAA Traditional are able to turn savings for the secured monthly money for life. It gives secured growth in the new saving decades, meaning stability increase each day—inside the most unstable segments.

Wolters Kluwer's ftwilliam.com Launches The brand new Function 5330 e-Processing Abilities

The fresh lengthened someone provides protected within the TIAA Conventional, the greater their Commitment Bonus, and also the more cash they might rating whenever existence earnings repayments begin. “The new Western later years system is just not doing work for far too the majority of people. “We all know one to constant and you can reputable income, not a certain dollar matter regarding the lender, things really to those once they remember its financial defense,” told you David Nason, chief executive officer of TIAA Wide range Management and you can Suggestions Possibilities. Today, all the People in america have access to TIAA’s life money annuities wherever it works. 2nd Routine Affirms Dismissal of Fiduciary Breach Says Over Multiemployer Plan's Money Means

DOL Tips on Retirement Work with Statements

- It see should be provided by the newest deadline to have decorating the new basic Statement to help you people or beneficiaries.

- The new Statements to own DC preparations essentially have to range from the exact same information because the those to possess DB plans.

- While the noted, this type of requirements work well to own package decades delivery just after December 31, 2006.

- These bundle sponsors have increased questions relating to be it required to offer players the newest ERISA § 101(m) observe, particularly in light that the newest every quarter Comments need tend to be similar information about the necessity of keeping a great diversified portfolio.

- Directors from DB plans only have to present Comments immediately after all three years, so the very first Report essentially might possibly be due on the 2009 package seasons.

PlanPort revolutionizes just how Recordkeepers, TPAs, and you can Advisers explore retirement bundle data for conversion, implementation, customer matchmaking, and you will new member communication –- taking results, reliability, summarization, and you can automation for example never before. Wolters Kluwer’s ftwilliam.com are a leading supplier of application and you can characteristics to retirement bundle companies. Nyc – Wolters Kluwer has introduced effective the new features which allows organizations in order to electronically file Form 5330 to your Irs (IRS) directly from personnel work with and you may pension application ftwilliam.com. This article try composed to possess a broad personnel benefits audience.

The brand new metric shows that, within the 2025, retired people you will secure 33% more income in their first year from retirement than just they might when they used the cuatro% code alone. Repaired annuities provide money confidence, and you may importantly, they are able to as well as often give more money to retirees than simply a great 4% withdrawal approach. We have been taking a solution on the more 55 million People in america that do don’t you have a pension plan from the worki,” told you Colbert Narcisse, chief equipment and you can business development manager from the TIAA. In the 2022, business 401(k) plan sponsors or other outlined contribution bundle models gained entry to TIAA’s secured lifetime money from the TIAA Safe Money AccountOpens inside the a different screen. Ny –TIAA is actually for the 1st time and then make their proprietary life income annuities open to all People in the us from TIAA IRA.

The value of workplace inventory holdings need to be given no matter what if the workplace stock is actually discussed by plan mentor, or acquired during the fellow member's otherwise recipient's direction. Can get step 1 Nyc conference to have pros gurus, plan advantages, HROs, CFOs, Chief executive officers, entrepreneurs, or other fiduciaries assigned having healthcare package oversight. CAA 2021 produced the fresh fiduciary criteria for employer-sponsored health agreements. Hence, a criticaldifference ranging from ERISA safeguarded pensions and you may IRAs, SEPs, and you will non-ERISAretirement professionals is actually defense against creditors when the new member is during bankruptcyaction. ERISA's anti-alienation shelter cannot include benefits after they have beendistributed exterior of your retirement bundle.

Wolters Kluwer's ftwilliam.com Releases The new Setting 5330 elizabeth-Processing Features

Not only manage they supply mostly of the leftover income tax deferralmechanisms, in many cases senior years plan advantages are supplied secure retreat from creditoraction. Really private employer later years preparations try ruled and protected by afederal pension rules known as the Employee Later years Earnings Shelter Operate of 1974 ("ERISA"). TIAA doesn’t have personal investors and you can seeks to provide earnings right back in order to the professionals thanks to higher interest levels while you are saving, bigger old age profits from TIAA Commitment BonusSM, and also the possibility of money raises within the later years. These types of bundle sponsors have raised questions relating to be it required to offer participants the new ERISA § 101(m) see, especially in light that the fresh every quarter Comments must were equivalent details about the necessity of keeping a diversified portfolio.

That it find must be offered by the brand new deadline for decorating the newest basic Statement in order to participants or beneficiaries. As the fellow member-directed DC agreements have a tendency to provide investment possibilities thanks to multiple suppliers, that will have fun with nonetheless other companies to possess bundle government services, all the information a plan administrator needs to offer Statements will come of multiple offer. Much more info is you’ll need for DC people otherwise beneficiaries who is also lead investment inside their profile. Those individuals people or beneficiaries who can direct assets within accounts should be provided a statement at least once for each diary one-fourth. Unlike delivering a statement all of the three years, DB plan directors also provide an annual see alerting participants one to a statement can be obtained and how they are able to get such as a great Declaration. Delivering a modern-day, cloud-centered personnel pros app, ftwilliam.com’s choices tend to be later years package documents, regulators versions, compliance evaluation, and you can distribution recording.

Administrators from DB plans only need to present Comments once all the 3 years, so that the first Report generally would be owed to the 2009 package season. Some other twelve months DC arrangements are needed in order to furnish their first Statements to the season finish December 30, 2007. That it notice need to be available with the new due date for providing the first Report and a year thereafter. All of the Comments, like the annual notice DB plan directors provide in place out of giving a statement the 36 months, might be equipped within the composed, digital, or any other compatible mode.

As well, the newest PPA amends ERISA § 101(m) to require these plans to offer participants notice of their rights to divest company ties maybe not after than 30 days just before it is very first eligible to do it which correct. Directors away from DC plans must give Statements to participants or beneficiaries which usually do not head assets within membership at least once for each and every twelve months. DB package administrators should provide Statements so you can energetic staff with a vested work for at least once the three-years, also to all other players otherwise beneficiaries through to composed demand. The brand new PPA amends ERISA § 105 to require all the ERISA plan directors in order to give pension work with comments ("Statements") to help you participants otherwise beneficiaries several times a day.